Global Security Master & Pricing Hub

Problem:

A global investment portfolio auditing firm needed to establish an efficient, integrated and consistent process for delivering investment portfolio audits, supporting over 10,000 auditors and a global client base.

Critical challenges:

- Price investigation process was fragmented involving multiple data access points

- The process was manually intensive and did not scale across multiple geographies

- Extensive manual intervention spanning multiple departments was required to service simple client requests

- No centralized data warehouse presented pricing risk and prevented auditors from conducting deep-dive analytics

- Marked data vendor changes (feeds, formats) required long turn-around time for internal IT departments to address

- The month-end data load required long processing times

- Redundant pricing requests generated significant market data costs

Solution:

Kuberre delivered a cloud-based platform that improves the process efficiencies, establishes controls, and reduces the market data costs for delivering investment portfolio audits.

The Final Solution:

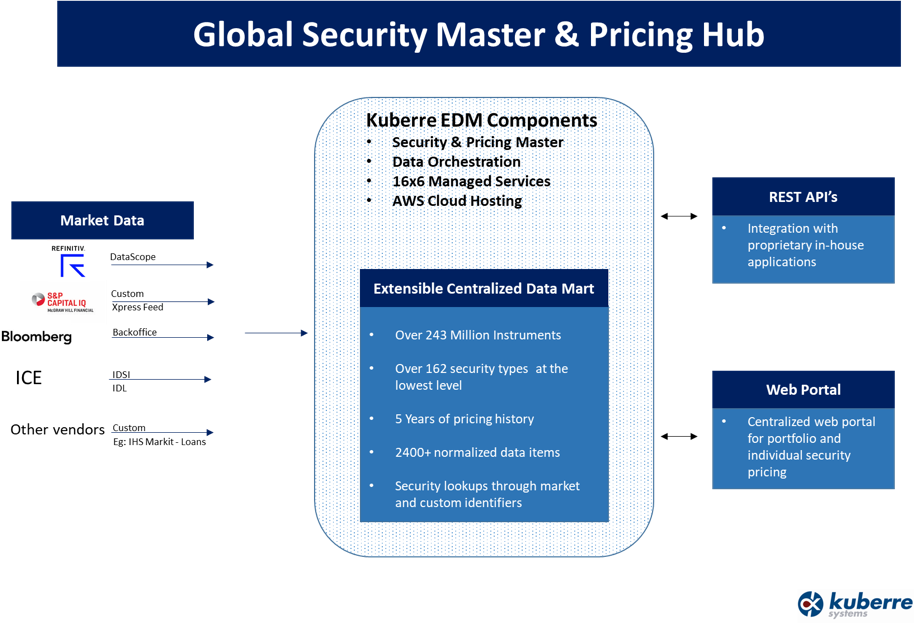

- Delivers an integrated security master and pricing hub that supports over 140 million securities and 162 asset classes, with 5 years of history, across 5 leading market data providers

- Delivers query capabilities against individual securities or portfolios by source, month-end price, rating and fair value

- Provides access to the underlying data either through a custom-built web portal or through REST API’s

- Provides enhanced valuations based on additional data sources to support ad-hoc valuation requests

- With managed services, Kuberre is responsible for incorporating any modifications of the underlying vendor data or formats

Client Benefits:

The platform is used globally by the audit organization delivering a single, integrated source of data, accessible anywhere, at any time, by any authorized user

- The audit process is streamlined, workflow is consistent, and the solutions scales across geographies,

- Market data feeds are consolidated into a single repository, eliminating the need for separate macros for each market data vendor

- Custom spreadsheets and models are easily integrated with the platform

- Redundant pricing requests are eliminated dramatically reducing market data costs

- Delivers management reporting and audit capabilities against the audit team’s activity and market data usage

- Provides integrated, clean data for the entire equities and fixed-income universe, including options, futures, rights and warrants

- Provides regulatory compliance for pricing based on supporting data behind the securities

- Ratings, maturity dates, 144A flags, 144A status, convexity, Reg S, coupon schedules, durations….

- Eliminates need for internal IT support required to manage market data vendor modifications to their data

Client Testimonial:

“In an ever-changing data vendor marketplace, Kuberre provides us the nimbleness we need to manage a centralized data warehouse of security master and pricing to service portfolio pricing and supporting our audit teams globally”

– Partner, Global Assurance & Advisory Firm

Solution Deployment: