Investment Risk & Attribution Platform

Problem:

A global top 10 asset manager was searching for an experienced technology partner to manage its investment risk data and client reporting functions. They required the multifaceted consolidation and orchestration of data between internal accounting and security master repositories and external analytics from Bloomberg PORT.

The client consulted with Kuberre, requesting a streamlined set of solutions for the optimization of its internal resource allocation, including:

- Data Management:

- Orchestrating data flows between existing internal systems and Bloomberg PORT.

- Consolidating security master holdings, transactions and portfolio analytics into a single repository to drive comprehensive client reporting.

- Creating User Defined Instruments (UDI’s) and proxies & incorporating associated id changes.

- Resolving data kick outs and exceptions.

- Ensuring data reconciliation between PORT holdings and ABOR.

- Support for Multi-Asset Class Portfolios:

- In cases of multi-asset class portfolios—in addition to complex instrument coverage, proxying for external funds, and accounting for fund of funds (FOF), the client also required the assurance of a continuous and accurate link to the underlying instruments in a multi-nested fashion.

- Custom Reporting on Risk & Attribution:

- The client was in critical need of custom data reporting to replace their inefficient process of compiling business unit reports from separate Bloomberg PORT data summaries, using Excel macros and cut-and-pastes to create a comprehensive (and often inconsistent due to manual errors) final report.

Solution:

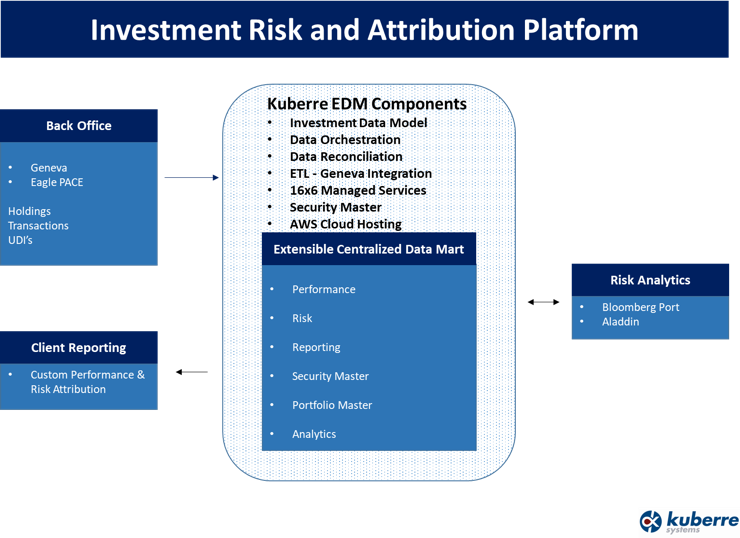

Kuberre took the client’s expansive list of data requirements and partnered with them to establish a fully-hosted and managed Investment Risk & Attribution Repository, as depicted in Figure 1.

The three main solution components included:

- Kuberre EDM Software: to support the client’s requirements of data aggregation, orchestration and integrity, and data reconciliation.

- Kuberre Managed Services: to support the client’s requirements of UDI setups, data exception resolution, and data reconciliation.

- AWS Hosting: a fully-hosted and managed PVC infrastructure on AWS.

Client Benefits:

- Internal Resource Optimization: the client’s high-value risk team was freed up from tedious day-to-day data management and integrity tasks, allowing them to direct more focus on vital business value adds.

- High Levels of Data Accuracy: where the client once faced stringent SLA’s, data integrity was outsourced to Kuberre for problem resolution, allowing for the immediate escalation of business issues that required critical attention.

- Cost Savings: the solution was managed, serviced and supported 24×7 by Kuberre for half the cost of the client’s pre-existing setup.

Client Testimonial:

“As our data management partner, Kuberre allows us to stay lean on our operational and data support and, at the same time, stay agile enough to get things done.” — Chief Operating Officer, Global Fixed Income Asset Manager, AUM > 250Bn

Solution Deployment: