Quantitative Research Platform

Problem:

A global insurance and asset management firm was seeking a technology platform to streamline its siloed quantitative processes and position it to accommodate future growth in AUM.

Critical challenges:

- The firm’s quantitative groups were siloed, with overlapping ideas but disparate systems.

- Redundant and expensive market data costs from an overabundance of access points and databases.

- Legacy development environments were laced with proprietary coding languages and scalability issues.

- Onboarding operations for new data scientists proposed key-person risk and lengthy training times due to proprietary coding techniques.

- Non-enterprise standards fell markedly short of compliance and audit requirements.

Solution:

A Three-Pronged Data Management Approach:

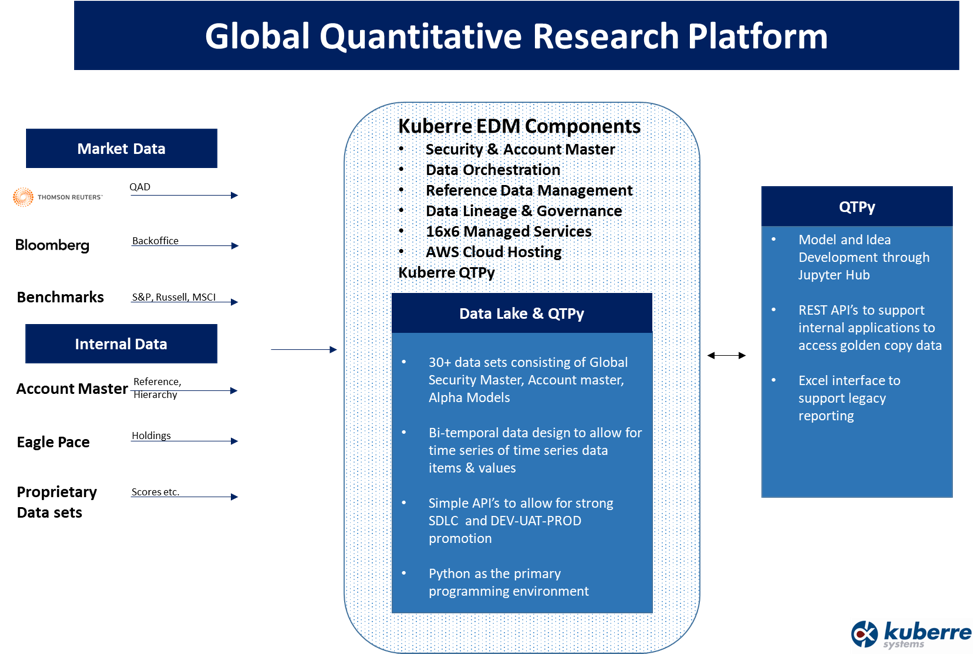

Kuberre’s solution to optimize the firm’s quantitative processes involved a three-pronged approach:

- Providing a centralized data repository with over 30 market and internal data feeds.

- Provisioning a one-stop Python based development environment for quantitative strategy development.

- Migrating and porting existing proprietary code and the underlying factor definitions into the new framework.

The Final Solution:

- A consolidated and fully-managed investment platform which hosts market data, portfolio and alpha scores while assuring data integrity and timeliness, implemented entirely with Kuberre-EDM components.

- A rich, federated data virtualization platform using Python as the primary programming environment that helps to incorporate new feeds for what-if scenarios, accelerate research and quantitative strategy development, implemented with Kuberre QTPy.

- The assurance of backward compatibility through professional Kuberre services that port existing models and factors into the new programming environment—offering thorough data reconciliation between old and new results.

- A streamlined workflow that enables a single code repository, shared across multiple quantitative teams and adhering to enterprise IT standards.

Client Benefits:

The firm can finally streamline its quantitative processes with a single data repository and a unified research platform, achieving a wide array of benefits:

- Significant cost savings through the consolidation of data vendors and elimination of redundant data access points.

- The mitigation of key-person risk due to the widely-recognized Python environment, allowing the firm to seamlessly onboard next-gen developers and support growing needs.

- Superior enterprise IT and security standard maintenance without the compromise on flexibility (which most quants require).

- Immensely scalable federated data architecture that supports users from multiple geographic locations.

- Data virtualization that isolates quants and data science teams from tedious data engineering tasks—accelerating research and reducing time-to-production for new ideas.

- Thanks to Kuberre’s Managed Services, the firm’s quants are freed up from solving mundane data normalization and quality issues, allowing them to direct more focus on key investment strategies.

Client Testimonial:

“Finding the right balance between giving quants the flexibility they need while establishing a platform that is operationally sound, scalable, next-gen ready and most importantly secure is always a challenge, but that is exactly what we were able to achieve with Kuberre solutions.”—COO, Global Asset Manager >$200Bn AUM

Solution Deployment: